- WSO Weekly Wrap Up

- Posts

- WSO Weekly Wrap-up

WSO Weekly Wrap-up

Hey WSO Monkey,

Just thought to let you know in case it might be of interest - we have a Financial Modeling & Valuation Bootcamp next weekend (Aug 9-10), where you can learn financial modeling from a top pro with IB and PE experience.

-Patrick

Top Discussions

When Will the Panic Alarm Sound for AI - "Junior roles won't go away, but classes will be half of what they are and the traditional pyramid team structure will turn into a line structure. Leading AI, error detection, and knowing how to get valuable output from agentic software will become the most important junior skill. Analysts, together with their associate, will be editors/superiors for the agents controlling output. Team could be 1-2 analysts, 1 aso, 1 VP, 1 MD and get the same output as a 15-20 person group of today. I think this will lead to better pay for the few remaining analysts, as retention becomes more valuable to the bank in order not to exhaust their entire junior pool (future dealmakers)."

Q&A: AVP in USD Rates Derivatives - "My answer would be, if you're good, very easy. I moved asset classes as an analyst 3, and then banks as an associate 1 (and again as associate 2, long story). I know it is frustrating advice, but really the key is getting in the door. If you want to trade vol, you're well positioned being rotational. Hone in on that, get good at that, and try to get there full time or at least get close to them, and tell them what you want. Once you're in the door, it's pretty relationship driven in terms of getting from A to B. Moving banks is just a matter of answering a DM from a recruiter on linkedin once you're a bit more senior..."

Pick a Path: VP - "I think you're looking at it the right way. The nuance is how crowded each is; if you joined EQT a couple years ago for example, even though it's MF size they were really building out US presence so a lot of runway to get promoted. On the flip side, there are MM funds (e.g. Kelso) that are super crowded and it'll take a ton of growth for there to be new partner slots opening up (if ever). Something to keep in mind in addition to everything you listed. In addition to looking for lean shops, you also need to find a place with hungry young-ish partners who are motivated to grow the pie rather than a less driven group of partners in their 60s who are trying to coast. The latter can be very hard to move up and may need to be resuscitated when or if a position does open."

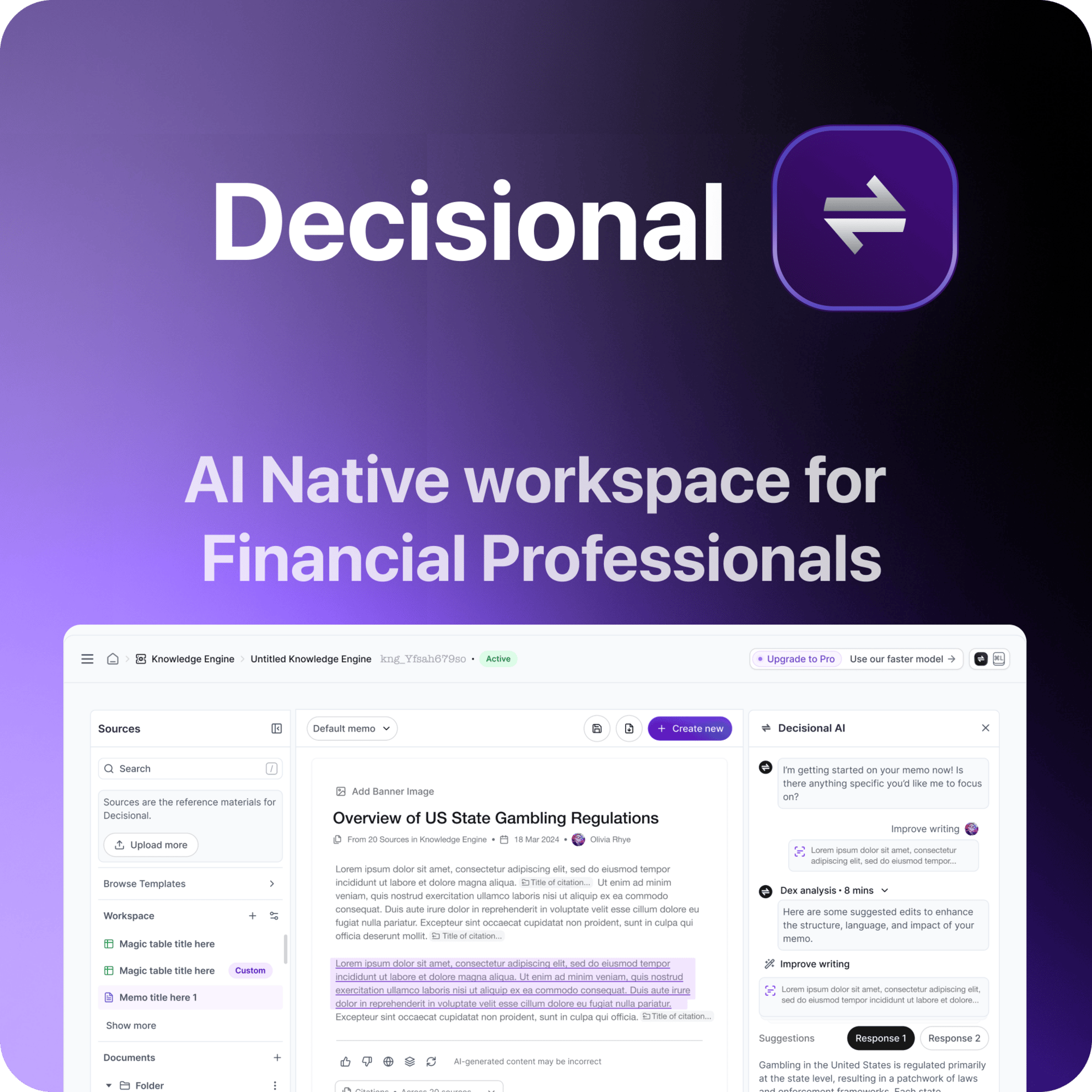

Transform Financial Research with AI Agents

Meet Decisional Knowledge Engines: the AI-native workspace designed for financial professionals who refuse to compromise on accuracy. Upload your entire data room and watch Dex, our specialized AI agent, extract insights with surgical precision. Unlike generic AI tools, we're built specifically for due diligence and investment analysis, delivering transparent citations that link directly to source documents. Handle multiple file formats seamlessly while maintaining full control over your analysis. Perfect for mid-market PE firms and wealth management companies conducting serious financial research.

Top Discussions (contd.)

Q&A: Corporate Finance - Senior Financial Analyst - "A little bit about me, I completed a Financial Leadership Development Program at a Bulge Bracket Bank, currently working in Corporate Finance as a Senior Financial Analyst doing forecasting, analytics, and stress testing for a product group at this institution at headquarters. Base salary is $90k in a low to medium COL city. TC including delayed stock comp and education benefits (not including 401k match nor health benefits) is roughly 105-115k. Work is interesting, got into the bank due to this jobs conference for accountants and luck mostly. The interview was easy and anyone with a finance background could easily pass it. Getting a job internally was slightly harder, but still pretty easy. Tbh this job is a blessing and I’m grateful every day to work with chill people..."

Q&A: From Non-Target to TMT ED / C-Level Fintech ($25BN+ Deals) - "I didn't go the classic PE route. I jumped to a C-level role at a fast-growing FinTech company. And now building my own advisory practice. Happy to discuss why I made those choices, the lifestyle/comp differences and the transition from IBD to Corporate Development & Strategy..."

Feeling Broken at Dream PE Job - "I feel invisible. The team culture is cold, bordering on toxic. There’s one particular VP who’s especially harsh. He talks down to people and does not tolerate even basic clarifying questions. I get pulled into projects midway with zero context, and if I make even a small mistake, it's blown out of proportion. Some associates/VPs behave like a clique, they talk over me or act like I haven’t contributed anything, even when I have. Even when I try to take initiative, I either get ignored or micromanaged to the point of feeling stupid. To cope from all this I have been stress eating, doom scrolling, and feeling like I have no control over anything. I feel anxious all the time, feel ashamed around my family, and numb most of the time at work..."

What Do You Love to Do? - "Judging by some of these responses here, it looks like most people don't have much going on besides work, drink, sleep, eat. I would say you need a purpose to really live life to the fullest, otherwise grinding for your job will eventually burn you out and you'll soon realise you spent 10 years grinding for a job that will replace you instantly. I think you absolutely need to have hobbies to make life fulfilling, pick up a sport, kickboxing, BJJ, hiking, mountain biking, literally anything that makes you excited for the weekend, other than to sleep and eat..."

New Podcasts Coming in Hot 🔥

University of Georgia to Real Estate Private Equity | Chat with Chandler | WSO Academy

University of Chicago to JPMorgan | Chat with Juan Pablo | WSO Academy

Hot Jobs 💼

AI Tutor - Finance Specialist - "You will be instrumental in enhancing the capabilities of our cutting-edge technologies by providing high-quality input and labels using specialized software. Your role involves collaborating closely with our technical team to support the training of new AI tasks, ensuring the implementation of innovative initiatives..."

Venture Capital Associate (Life Sciences, Boston based) - "The team is seeking an Investment Associate to join as a generalist across their three sector focuses (biotech, digital health/tech, and tools/diagnostics) in Boston metro with an ASAP or Summer 2025 start date..."

Equity Research Analyst - "Buy-side research analyst opportunity with a family office. The analyst will work with the direct investment team and report to the Portfolio Manager. The team employs a fundamentally driven investment process and an owner’s mentality...."

Research Associate (Equity Small Mid Cap) - New York, NY - "This position will support the Small/Mid-Cap Equity research team and initially be responsible for covering multiple sectors in support of current team members."

On Deck - Training 🎓

All in Eastern Standard Time

Aug 9, 10am - 6pm - FMV Bootcamp** (Open Now)

Aug 16, 10am - 2pm - IB Interview Bootcamp*** (Open Now)

Aug 23, 10am - 6pm - Foundations Bootcamp (Open Now)

Aug 30, 10am - 2pm - Case Interview Bootcamp (Open Now)

Aug 30, 10am - 12pm - Pitch Me a Stock Bootcamp (Open Now)

Aug 31, 10am - 2pm - Networking Bootcamp (Open Now)

Sep 6, 10am - 2pm - VC Bootcamp (Open Now)

Sept 13, 10am - 6pm - FMV Bootcamp** (Open Now)

Sep 20, 10am - 2pm - IB Interview Bootcamp*** (Open Now)

Sep 27, 10am - 2pm - RE Modeling Bootcamp (Open Now)

Stay Strong,

Patrick Curtis

CEO and Founder, WallStreetOasis.com

PS - We're also always looking to add resume reviewers and WSO Mentors to our team. Set your own pay (from $40/hr to up to $400/hr) to increase or decrease mentee flow. To submit an application, go here.

PPS - Think you have an interesting story? Want to share it with our podcast listeners? Hit reply and let me know!

* PE Interview Bootcamp includes lifetime access to the PE Interview Course

** FMV Bootcamp includes lifetime access to the Elite Modeling Package

*** IB Interview Bootcamp includes lifetime access to the IB Interview Course