- WSO Weekly Wrap Up

- Posts

- WSO Weekly Wrap-up

WSO Weekly Wrap-up

Hey WSO Monkey,

Dive into this week’s hottest discussions: a breakdown on where the 2+2 (+2) path actually leads, a surprisingly relatable post on staying focused during long days, and a VP reflecting on whether the trade-offs up the ladder are worth it.

Also on deck are a look into Houston O&G IB, thoughts on secondaries in 2025, and Moelis apparently springing a 5-hour surprise modeling test on interns (because why not).

Catch up when you’ve got a minute.

-Patrick

Top Discussions

The Real Reason Why Houston O&G IB Is Sweaty - "Agree with the above but beyond this, there are additional reasons that oil & gas is so sweaty: an endless amount of acquisition and divestment ideas. You can always pitch a dozen offset acquisitions to any player plus you can pitch other basins and out of the box ideas. On top of that, everyone has some junk that they could divest. Deal activity as far as deals closed can speed up or slow down but you can essentially keep pitching hard in any price environment..."

Secondaries Outlook 2025 - "I think it is a great place to be in the next 5-10 years. Pay may always be discounted to some extent from traditional PE, but it's still a lot of money and seems like any carry has a better (and quicker) chance of coming to fruition. Not sure many people actually exit from this to PE/VC (other way around really), if you did move it would likely be to some family office doing primary directs and secondaries."

Moelis Intern 5-Hour Surprise Modeling Test - "Hearing from sources that Moelis interns had a surprise 5 hour modeling test this week where they had to build a 300+ line LBO and make a merger model on the CoreWeave deal, all from scratch. Supposedly the test holds significant weight on return offer decisions. The place has truly become a sweatshop since Ken’s decision to step down."

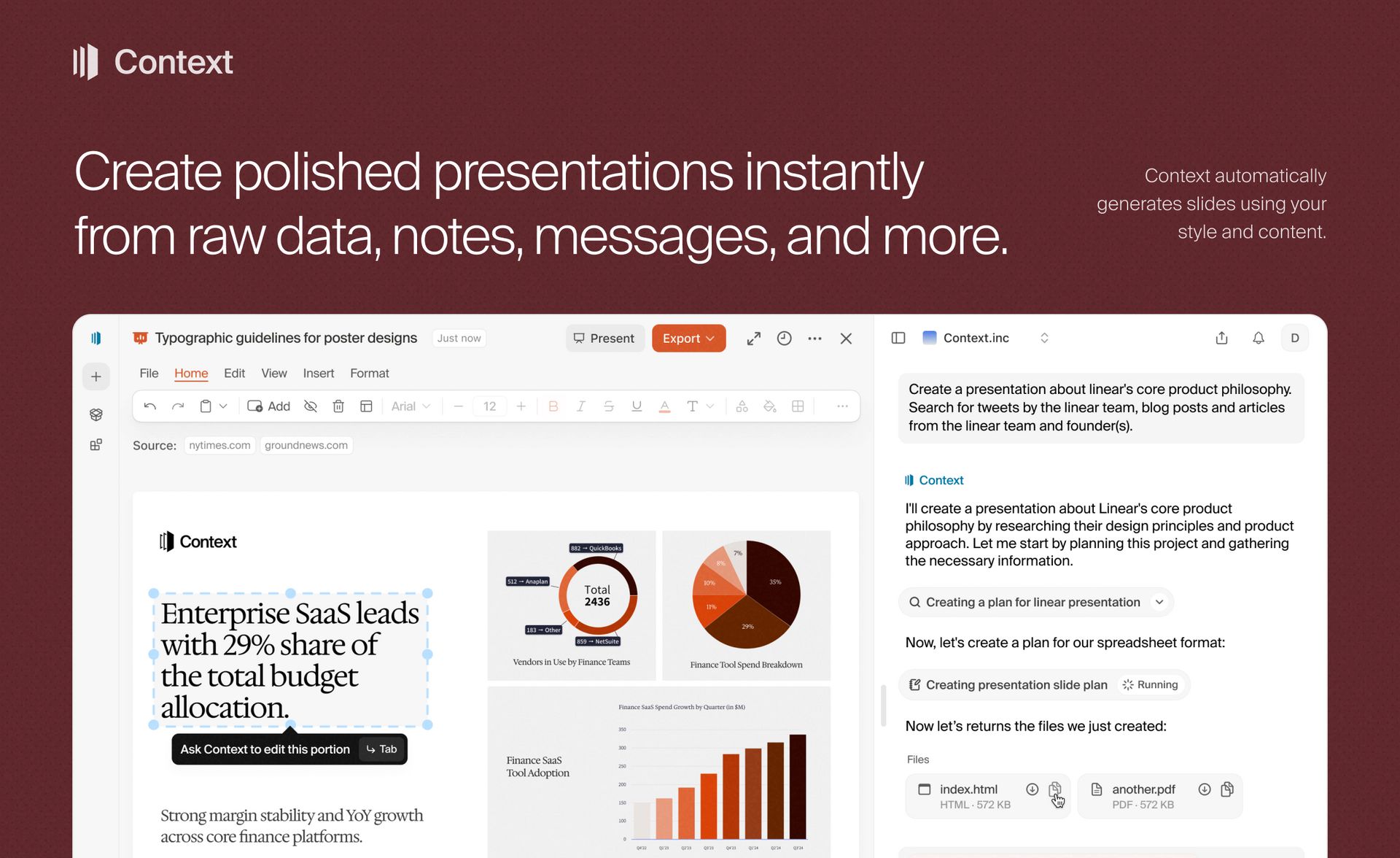

Context: Your AI Analyst

Pulling another all-nighter updating models? Skip it.

Context is the first AI office suite built for Wall Street workflows. It learns your formatting templates, writing voice, and modeling conventions—then produces work exactly the way your team expects.

How it works

Connect your stack

Excel, PowerPoint, Outlook, Slack, Google Drive, CapIQ / FactSet, and 40 + other sources.Pick finance workflows to automate

Three-statement model roll-forwards

Comparable-company & transaction comps decks

Earnings-flash spreadsheets and slides

Investment memos & market-update emails

End-to-end deal process task lists

Context learns your style

From font choices to footnote phrasing and color-coded sensitivities, it mimics your house style—no re-formatting needed.

The impact

Teams at top funds and bulge-bracket banks have reported 15–20 hours saved per analyst every week—time they now spend on higher-value analysis (or finally catching some sleep).

Top Discussions (contd.)

The New 2+2 (+2) - "I've been giving it great thought lately on what a career can look like post associate PE years. On this forum, the 2+2 and the 2+2+2 have historically been viewed as the highest ROI career paths. While I still believe this is true, any PE professional on this forum knows the X years that follow the 4 or 6 is the single biggest decision you make up until that point. The opportunities following 2+2 or 2+2+2 are immeasurable with outcomes unquantifiable as it pertains to career trajectory (down river PE fund, HF, CD, FP&A, tech, ops, venture, etc.)..."

How to Stay Sharp Throughout the Day? - "When I felt this onset i started consuming high protein snacks, lots of water & chewing gum. Snacks kept my stomach full (helps keep me awake ymmv), lots of water (does the same + built in walks to the bathroom), and im fidgety so gum gives me something to do while doing work. Feel much more focused throughout the day but gets harder after midnight (duh)."

VP in IB, Are You Happy? - "There are pros and cons to each level of the job and while you are no longer in weeds and grinding from an hours perspective at the VP-level, you are under more pressure, especially as a more senior VP. For example, at the analyst/associate level, I cared but never really worried or stressed at big deal milestones (IOIs, LOIs, etc.). Now it's more stressful as I know I'm the one getting a call saying "WTF happened" from the client if things don't go well. In terms of happiness, I've found a better routine and much more balance outside of work the last few years which has really helped with staying sane, alleviating stress from work and generally being happy in life. As mentioned above, while truly unplugging can be difficult, I have a much more disciplined workout routine, have hobbies outside of work, became involved in a cause/charity I'm passionate about and continue to get better at prioritizing time for family and friends on weekends and free weeknights."

New Podcasts Coming in Hot 🔥

UCLA to William Blair | Chat with Andrew | WSO Academy

Western University to BMO Capital Markets | Chat with Devin | WSO Academy

University of Toronto to Scotiabank | Chat with Aditya | WSO Academy

Hot Jobs 💼

AI Tutor - Finance Specialist - "You will be instrumental in enhancing the capabilities of our cutting-edge technologies by providing high-quality input and labels using specialized software. Your role involves collaborating closely with our technical team to support the training of new AI tasks, ensuring the implementation of innovative initiatives..."

Venture Capital Associate (Life Sciences, Boston-based) - "The team is seeking an Investment Associate to join as a generalist across their three sector focuses (biotech, digital health/tech, and tools/diagnostics) in Boston metro with an ASAP or Summer 2025 start date..."

Equity Research Analyst - "Buy-side research analyst opportunity with a family office. The analyst will work with the direct investment team and report to the Portfolio Manager. The team employs a fundamentally driven investment process and an owner’s mentality...."

Research Associate (Equity Small Mid Cap) - New York, NY - "This position will support the Small/Mid-Cap Equity research team and initially be responsible for covering multiple sectors in support of current team members."

On Deck - Training 🎓

All in Eastern Standard Time

July 26, 10am - 2pm - IB Interview Bootcamp*** (Open Now)

July 26, 1pm - 5pm - VC Bootcamp (Open Now)

Aug 2, 10am - 6pm - PE Interview Bootcamp* (Open Now)

Aug 9, 10am - 6pm - FMV Bootcamp** (Open Now)

Aug 16, 10am - 2pm - IB Interview Bootcamp*** (Open Now)

Aug 23, 10am - 6pm - Foundations Bootcamp (Open Now)

Aug 30, 10am - 2pm - Case Interview Bootcamp (Open Now)

Aug 30, 10am - 12pm - Pitch Me a Stock Bootcamp (Open Now)

Stay Strong,

Patrick Curtis

CEO and Founder, WallStreetOasis.com

PS - We're also always looking to add resume reviewers and WSO Mentors to our team. Set your own pay (from $40/hr to up to $400/hr) to increase or decrease mentee flow. To submit an application, go here.

PPS - Think you have an interesting story? Want to share it with our podcast listeners? Hit reply and let me know!

* PE Interview Bootcamp includes lifetime access to the PE Interview Course

** FMV Bootcamp includes lifetime access to the Elite Modeling Package

*** IB Interview Bootcamp includes lifetime access to the IB Interview Course