- WSO Weekly Wrap Up

- Posts

- WSO Weekly Wrap-up

WSO Weekly Wrap-up

Hey WSO Monkey,

If you’ve ever wondered why offices look worse, comp feels random, and everyone else’s internship seems better than yours, you’re not alone. This week’s threads hit all of that plus some markets chatter. Scroll through whatever feels closest to what you’re overthinking right now.

-Patrick

Top Discussions

Q&A - Commodity Grad Program Trader - "Some background on me - I'm currently a commodity grad program trader at a top major, who graduated from a very non-target university (low-level state school). Networking was like a full-time job for me, on top of running student groups and being involved. Graduated with a traditional finance degree, nothing too special. Had internships in financial advising (equity research for an advisor), buy-side equity research, private credit, and then my grad program..."

What Happened to Workplace Aesthetic? - "Offices used to be beautiful. Inlaid wood, warm lighting, marble and other quality materials, plants, and so on. Even the more plain environments were still professional in nature. Still welcoming. But the last 3 I’ve worked in ( since 2014ish) have been super ugly and minimalist. Exposed ventilation. Piercing lighting. No color (desks, walls, ceilings are all white and antiseptic). Mismatched, abrasive furniture (if you could even call it furniture). Construction paper and marker all over the dry erase walls, which are everywhere. Just generally cold and depressing..."

Why Most AI Efforts Fail and How to Succeed - “MIT’s report reveals that 95% of AI initiatives fail to deliver ROI due to stalled pilots, misaligned budgets, and ineffective tools. Successful organizations focus on high-value use cases, partner with trusted vendors, and integrate AI with daily systems. Blueflame AI clients achieve measurable results, like saving 10 hours per CIM analysis and boosting outreach efficiency by 60%.”

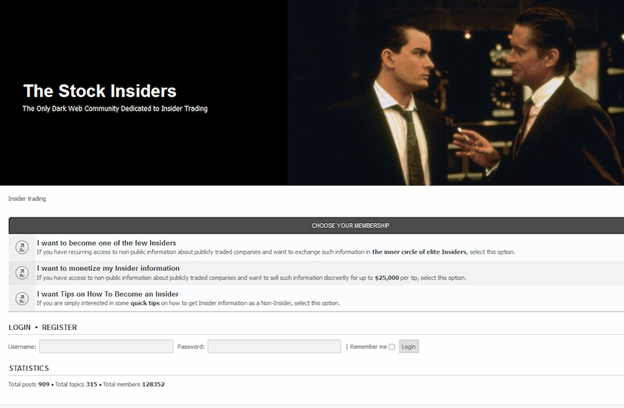

What Happens Inside a Dark Web Insider Trading Forum? We Asked the Admin.

There’s a place on the dark web where high-finance professionals anonymously trade material non-public information like currency.

I spoke directly with the forum’s admin - a guy who has watched hundreds of real insider trades happen behind digital masks.

He breaks down how the community operates, how they avoid detection, and why regulators have no clue this place exists.

Top Discussions (contd.)

Major Media Move: Netflix to Acquire Warner Bros. For ~$82.7b | Moelis/WF Advises NFLX ; Evercore/JPM/Allen Advises WBD - "I think there's an argument to be made that the streaming industry is so fragmented that it has become annoying. I don't want to get Peacock and Hulu to watch this show and Tubi, Nutty, Goopi, and Shaftstick to watch these other shows. And then I'm paying $100 a month for YouTube TV and don't even get NFL games from my OWN division FFS, so I gotta pay extra for NFL whatever the fuck it is. And then there's AppleTV for this new show, and Paramount for this other one, and on and on and on. Not saying this is the solution, but god damn is it a mess for the consumer regardless."

How Much Are People Actually Making in PE? (All-in Comp) - "I’m curious how much people are actually taking home in PE, all-in, by fund size / role / region, not just what “should” be paid on paper. Especially interested in how much variance there really is once you factor in bonuses and carry (or lack thereof)..."

Can Consulting Be as Technical as IB? - "Technicality is a vague term and implies far more than Excel modeling, so there are other areas where you could say consulting is more technical. I will give one example. Take a buy side carve out where you are trying to set up a new IT function from scratch. In this particular instance, if you hire IT consultants to facilitate the IT integration and build out an IT department from scratch, then yes that is more complex than the M&A diligence related to IT. But then again, when you zoom out, and think about how the buy side team covering a much larger scope than just the IT integration (probably a simple line or a tab in the model), it becomes clear that again which group is actually more "technical" is subjective / arbitrary."

What’s the Deal With These European Interns? - "No hate at all, just genuinely curious here. Some of the best - as well as nicest - colleagues I have met fall into this category and I have no resentment for the system whatsoever. I’m sure anyone in London notices this too, that there is a never-ending supply of European interns who are way over-qualified to be an intern. These guys seem to be 22-26 years old, already having completed several internships, often internships in both IB and PE, at reputable firms and having received full-time offers. Yet they pursue further internships..."

New Podcasts Coming in Hot 🔥

Breaking Into Investment Banking: Vamshi’s Journey from UChicago to Private Equity Success

WSO Academy Mentor Reveals: How Students Break Into Top Finance Roles

From Brazil to Wall Street: Arthur’s Journey Through Wharton, Banking, and Finding Purpose

From Business Data Science to Banking: My Journey & Lessons for Students

Hot Jobs 💼

Finance Expert - “Mercor is recruiting U.S./UK/Canada/Europe/Singapore/Dubai/Australia-based Investment Banking or Private Equity Experts for a research project with a leading foundational model AI lab.”

Private Equity Expert - “Mercor is recruiting U.S./UK/Canada/Europe/Australia-based Private Equity Experts for a research project with a leading foundational model AI lab.”

Insights Senior Manager/Principal, Private Equity - "The Insights Private Equity group at Dialectica plays a key role in driving growth and scaling an emerging business unit within the company..."

Investment Banking, Private Equity, and Hedge Fund Professionals - "This is a remote, part-time role ($100-$150/hr; 20-40hr/week) where you'll apply your foundation in accounting, valuation, and financial modeling to create high-quality content used to train AI models. You’ll break down real-world finance scenarios, craft rigorous problem sets, and translate complex concepts into clear, structured reasoning across corporate finance, accounting, and investment analysis. Ideal for IB/PE/HF professionals with 1-5 years of experience looking for part-time work while contributing to AI development."

Pre-MBA Private Equity Associate - "We are seeking a Pre-MBA Private Equity Associate to join our team for a Summer 2027 start..."

Private Equity Investment Associate ~ Advanced Industrials ~ San Francisco - "This role offers a unique opportunity to gain hands-on exposure across the full private equity lifecycle, from deal sourcing and due diligence to portfolio value creation, working directly alongside senior investors and portfolio executives..."

Financial Modeling Expert - "In this highly visible role, you will deploy your deep expertise in financial modeling, valuation, and deal structuring to support major investment decisions across diverse sectors..."

WSO Mentor - "Are you an experienced professional with a background in investment banking, private equity, hedge funds, S&T, venture capital, asset management, equity research, quant finance, corporate dev, real estate finance, or top-tier consulting? Passionate about mentoring the next generation of leaders? Wall Street Oasis (WSO) is expanding its Mentorship Program, and we're looking for outstanding professionals to join our mentor roster—an elite network supporting students and young professionals as they prepare for high-stakes careers. Whether you’re looking to give back, stay connected to rising talent, or sharpen your coaching skills, this role offers you the chance to make a meaningful impact, remotely and on your schedule..."

Research Associate (Equity Small Mid Cap) - New York, NY - "This position will support the Small/Mid-Cap Equity research team and initially be responsible for covering multiple sectors in support of current team members."

On Deck - Training 🎓

All in Eastern Standard Time

Dec 13, 10am - 6pm - PE Interview Bootcamp* (Open Now)

Dec 13, 10am - 6pm - FMV Bootcamp** (Open Now)

Dec 20, 10am - 2pm - IB Interview Bootcamp*** (Open Now)

Jan 10, 10am - 2pm - IB Interview Bootcamp*** (Open Now)

Jan 11, 10am - 6pm - Foundations Bootcamp (Open Now)

Jan 11, 10am - 2pm - Networking Bootcamp (Open Now)

Jan 17, 10am - 6pm - FMV Bootcamp** (Open Now)

Jan 24, 10am - 2pm - VC Bootcamp (Open Now)

Jan 31, 10am - 2pm - RE Modeling Bootcamp (Open Now)

Stay Strong,

Patrick Curtis

CEO and Founder, WallStreetOasis.com

PS - We're also always looking to add resume reviewers and WSO Mentors to our team. Set your own pay (from $40/hr to up to $400/hr) to increase or decrease mentee flow. To submit an application, go here.

PPS - Think you have an interesting story? Want to share it with our podcast listeners? Hit reply and let me know!

* PE Interview Bootcamp includes lifetime access to the PE Interview Course

** FMV Bootcamp includes lifetime access to the Elite Modeling Package

*** IB Interview Bootcamp includes lifetime access to the IB Interview Course