- WSO Weekly Wrap Up

- Posts

- WSO: Underqualified Associates-To-Be

WSO: Underqualified Associates-To-Be

Hey WSO Monkey,

We're excited to announce a new 4-hour Case Interview Bootcamp!

Join us on Saturday, Nov 16th at 10 AM ET for an intensive session covering case interview basics, essential frameworks, and key quantitative skills, plus hands-on practice. Sign up here

-Patrick

Top Discussions

What We Can Learn From All These “Depressed and Burnt Out” Posts Re: IB and PE - "Why is it helpful to have this discussion? Well, if you're a college student struggling to figure out what to do with your life, and you feel that you don't fall neatly into any of these three buckets, then this is a great time to sound the alarm. It's time to seriously introspect and do work to figure out who you are, and make career decisions accordingly, or else you may find yourself in the very same shoes. Just look at all these anti-IB and PE posts, look at all the people in the comments of these posts, look at how they suffer. This could very well be you one day, but know that there are things you can do to avoid it..."

My Analysts Are Not Qualified and They Are Becoming Associates - "VP here and I am getting very frustrated with how the situation is racing to the bottom at my MM shop. I have gone through the process myself and by "not qualified" I meant really unqualified so read below before trashing me..."

Avoid AI Surprises in Your M&A Deals - "Many M&A deals collapse due to doubts about AI assets. If you’re targeting deals that could involve AI assets, find out how to enhance your due diligence in six crucial areas. Datasite’s AI due diligence checklist helps you wise up to the risks surrounding data provenance, security, intellectual property, compliance, and much more."

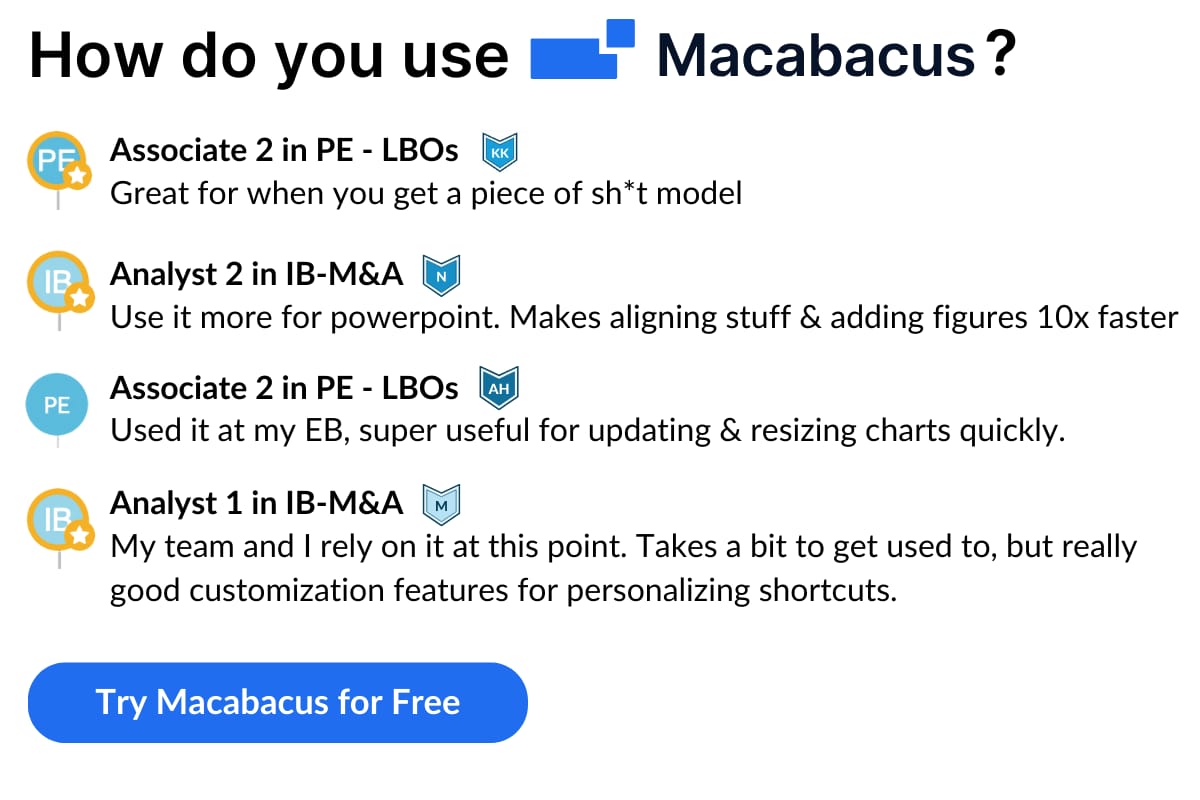

Macabacus: Your All-in-One Solution to Simplify Decks and Presentations

We get it—working late wasn’t part of the dream when you took the job, but wrestling with Excel, PowerPoint, and endless "critical updates" from your boss may have become all too familiar.

Macabacus helps Wall Street teams streamline the creation and management of presentations, assets, and slides, all in one place. While others waste time adjusting slides manually, you’ll have a polished, on-brand deck ready with just a few clicks. Discover tools designed to make your workday (and your evenings) easier:

🔍 Instant Search: Quickly search for slides by deal type, sector, or transaction size to find exactly what you need.

⭐ Saved Templates: Star go-to templates for effortless formatting, ensuring your most-used slides are always ready.

📂 Shared Libraries: Access a full suite of pre-approved slides and assets available to your entire team.

🧠 Smart Filters: Use metadata tagging to zero in on logos, transaction details, and key visuals in seconds.

Macabacus keeps your presentations as sharp as your analysis—without the late nights.

Top Discussions (contd.)

Do You Regret IB? - "It was a huge mistake because IB is so retarded and physically grueling at the junior level, and my health and relationships with my family/friends were certainly negatively affected. I just started my buyside role at a public/private credit shop (after 2yrs of IB), and I literally could’ve got this same exact role if I did credit research. Would’ve been way more relevant and interesting to me, and I wouldn’t have gone crazy working 100 hours a week with toxic colleagues..."

Staying Optimistic After a Terrible Earnings Season - "The important takeaways I have for you is that you always communicate and track your errors (even positive PNL bets that moved for reasons other than your thesis), and that you've managed to identify why things haven't gone your way to your PM / committee / higher ups. Your process needs to improve, always, regardless of MTD or QTD PNL being up or down."

Struggling to Exit From Consulting to PE - "I've been wanting to make the move into private equity for a while now, but am not getting any interviews. Everyone I speak to says they are only looking for bankers, and I have sent literally hundreds of applications out. I am willing to join an investment bank first if needed, but most banks only hire recent university grads for the analyst level and experienced bankers for the associate level. I am happy to go to business school as well, but from what I've read on this forum, without prior PE experience, an MBA will not help..."

WSO Alpha - Latest Updates 📈

We uploaded the October brokerage report for those of you curious about how we did.

Hot Jobs 💼

Investment Banking Analyst - “A boutique IB practice focused on MM M&A. Lean, mean, entrepreneurial team of highly motivated deal makers who all ‘punch above our weight’. While other investment banks have large teams working around the clock, we work smart in small teams, and achieve outstanding results for our clients and still get home in time to see our families. Industry generalists…“

Investment Analyst - "...invests in privately held companies across media and entertainment, including film and television, digital media, creator economy, video games, live experiences, sports, and related services and enabling technologies ..."

Director of M&A - "...formed to be the best long-term home for independent companies that provide unique data, content or information focused on small but important niches and are owned and operated by founders."

Sr Discretionary Researcher / Trader - Fully Remote - "We are a discretionary, event-driven proprietary trading firm and hedge fund specialized in the digital asset space."

Marketing Manager - West Coast, US - "The Firm is an early-stage venture capital firm with $300mn in assets under management and a deep commitment to supporting the next generation of groundbreaking technology..."

Research Associate (Equity Small Mid Cap) - New York, NY - "This position will support the Small/Mid-Cap Equity research team and initially be responsible for covering multiple sectors in support of current team members."

On Deck - Training 🎓

All in Eastern Standard Time

Nov 16, 10am - 2pm - IB Interview Bootcamp*** (Open Now)

Nov 16, 10am - 2pm - Case Interview Bootcamp (Open Now)

Nov 16-17, 10am - 6pm - FMV Bootcamp** (Open Now)

Dec 14-15, 10am - 6pm - FMV Bootcamp** (Open Now)

Dec 14, 10am - 6pm - PE Interview Bootcamp* (Open Now)

Dec 21, 10am - 2pm - IB Interview Bootcamp*** (Open Now)

Jan 4, 10am - 6pm - Foundations Bootcamp (Open Now)

Stay Strong,

Patrick Curtis

CEO and Founder, WallStreetOasis.com

PS - We're also always looking to add resume reviewers and WSO Mentors to our team. Set your own pay (from $40/hr to up to $400/hr) to increase or decrease mentee flow. To submit an application, go here.

PPS - Think you have an interesting story? Want to share it with our podcast listeners? Hit reply and let me know!

* PE Interview Bootcamp includes lifetime access to the PE Interview Course

** FMV Bootcamp includes lifetime access to the Elite Modeling Package

*** IB Interview Bootcamp includes lifetime access to the IB Interview Course